Nonprofit taxes - An Overview

- Updated April 21, 2023 - 2.00 PM - Admin, ExpressTaxExemptNonprofit organizations are exempt from paying federal income taxes to the IRS. To qualify as tax-exempt, an organization must be providing public services without the goal of making any profit.

This article takes a detailed look at what tax-exempt status is and the annual tax returns that these organizations are required to file.

Table of Contents:

1. Which organizations are considered tax-exempt?

2. How to apply for tax-exempt status

3. Advantages of tax-exempt status

1. Which organizations are considered tax-exempt?

Organizations that meet the requirements under IRS Section 501(c)(3) qualify for tax-exempt status and are not required to pay federal income taxes.

Organizations that exist solely for a “charitable purpose” are defined by 501(c)(3) and are eligible to apply for tax-exempt status.

Religious activities, Charitable activities, Scientific activities, testing for public safety, literary, or educational purposes, fostering national or international amateur sports competition [or] the prevention of cruelty to children or animals are all considered “charitable purposes”.

While the Internal Revenue Service (IRS) recognizes more than 30 types of nonprofit organizations, only those that qualify for 501(c)(3) status are considered tax-exempt.

Most organizations that may be eligible for 501(c)(3) designation fall into one of these categories:

- Charitable Organizations

- Education Institutions

- Churches and Religious Organizations

- Private foundations

2. How to apply for tax-exempt status

To be eligible for Recognition of Exemption Under Section 501(c)(3), an organization should be elected by the IRS under one of the following business types. These organizations are

- Trust

- Corporation

- Association

If the organization falls under any one of the categories above, you can start applying for

tax-exempt status:

-

Gather your organization’s documents

- Articles of incorporation for a corporation

- Articles of organization for a limited liability company

- Articles of association or constitution for an association

- Trust agreement or declaration of trust

- Determine your state’s registration requirements

- Obtain an employer ID number (EIN) for your new organization

- Finally, submit your Form 1023 or Form 1023-EZ with the IRS to apply for exempt status.

3.Advantages of tax-exempt status

Organizations with tax-exempt status are eligible for many benefits:

- Tax-exempt organizations are eligible for federal exemption from payment of corporate income tax.

- Organizations that are exempt under Section 501(c)(3) are eligible for public and private grants.

- These organizations are eligible to receive tax-deductible gifts under IRC section 170 and have a high possibility of being exempt from state and local taxes, not to mention bulk postage rates.

- Exempt organizations have limited liability, i.e., the founders, directors, members, and employees are not personally liable for the nonprofit's debts.

4. Federal tax filings requirements for nonprofits

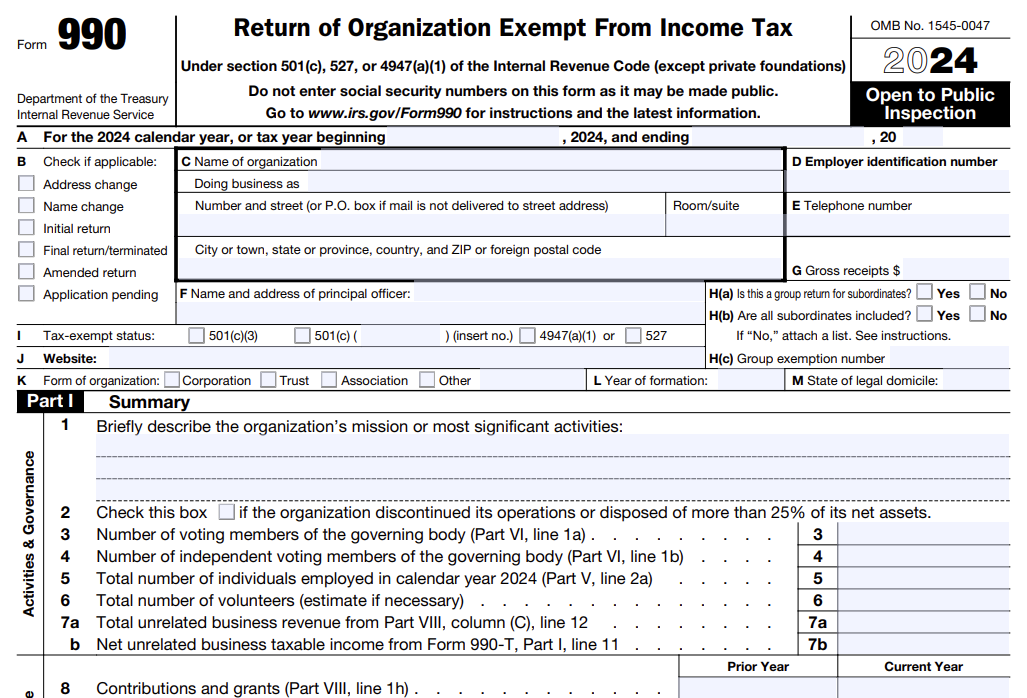

Even though the organization is exempt from paying taxes, it must file an annual tax return to the IRS to report its financial and fundraising activities, donors and contribution information, and more related to the nonprofits conducted during the tax year. This is done using the 990 Series forms.

The IRS makes 990 returns available to the public. This information is used by donors to ensure that they are donating to organizations that are good stewards of their funds. Organizations must report contributions details on Form 990 returns.

Tax-exempt organizations that fail to file their 990 tax returns on the deadline can be charged an IRS penalty. Organizations that fail to file their 990 for three tax years in a row will have their tax-exempt status automatically revoked.

What kind of tax returns do nonprofits file?

The IRS designed the different forms in the 990 series for organizations to choose from based on their financial status. Organizations should file the 990 return that aligns best with their assets, annual gross receipts, and public charity status.

- IRS Form 990-N (e-Postcard) - if the Organization's gross receipts are $50,000 or less. However, you may voluntarily file Form 990-EZ or 990 instead.

- IRS Form 990-EZ, Short Return of Organization Exempt from Income Tax - if the Organization's gross receipts are less than $200,000 and total assets under $500,000. These organizations may also voluntarily file Form 990.

- IRS Form 990, Return of Organization Exempt from Income Tax - if the Organization's gross receipts are more than $200,000 or when the total assets are over $500,000.

- Regardless of the financial status, Private Foundations should file the annual tax return IRS Form 990-PF, Return of Private Foundation.

Create a free account with ExpressTaxExempt to begin filing the nonprofit 990 tax forms you need to maintain your organization’s compliance. We provide an easy filing process and instant IRS updates on the status of your form.

When is the deadline to file nonprofit taxes?

Tax-Exempt Organizations must file their Form 990 returns with the IRS by the 15th day of the 5th month after the end of the organization’s accounting period.

If the Organization follows the calendar tax period (the accounting tax period acts from January 1 - December 31), the Organization must file Form 990 on or before May 15.

Find your 990 filing due dates here: https://www.expresstaxexempt.com/form-990-due-date/.

Operating on a fiscal accounting tax period? Try our 990 due date calculator to determine your

990 deadlines.

How to file nonprofit tax returns?

The IRS mandates that nonprofits file their 990 tax returns electronically. Filing the return electronically makes it easier for the IRS to process the returns quickly.

Note: The Taxpayer First Act, enacted July 1, requires tax-exempt organizations to file all the 990 and related forms electronically. i.e., organizations' tax year beginning after July 2019 must file their 990 returns electronically.

Choose an IRS-authorized e-file service provider such as ExpressTaxExempt to e-file your nonprofit 990 Forms securely. ExpressTaxExempt supports all 990 forms along with required schedules.

What happens if you submit the incorrect nonprofit tax return?

If an organization’s return is incomplete or the organization filed the wrong return, the IRS will send it back with one of the following letters:

- Letter 2694C Returning Form 990 due to Missing Information

- Letter 2695C Returning Form 990-EZ due to Missing Information

- Letter 2696C Missing Information Request to Process EO Return

If the information in the return is incorrect, you must file an amended return with the IRS. The amended return must provide all the information requested in the form and instructions, not just the new or corrected information.

To avoid penalties, include a reasonable cause explanation of why you didn't initially submit all the required information with your return. The IRS may charge you a penalty if you fail to provide the missing or incomplete information and a reasonable cause explanation.

5. State Nonprofit tax filing requirements

If a charitable nonprofit is determined to be an incorporated entity, it must follow state law requirements for annual or periodic registrations. Each State’s registration process will differ.

- Nonprofit corporations must periodically confirm or update their basic contact information, such as mailing address, names of responsible parties, and registered agents.

- If a charitable nonprofit has employees, there are initial and periodic employment forms to file with the state Department of Labor.

- In some states charitable nonprofits need to apply for sales/use or property tax exemptions, separately from other corporate registrations.

- In addition, the majority of states require charitable nonprofits that are engaged in soliciting donations to register with the state to report on the nonprofit’s fundraising activities.

Annual state filing requirements for nonprofits

While nonprofits use Form 990-N (e-Postcard), Form 990-EZ, Form 990, or Form 990-PF to complete their federal filing requirements, state agencies require organizations to file a separate state return with them.

Some states have also mandated the annual filing of the tax return for the organization to maintain its tax-exempt status. The annual information return (also known as IRS "Form 990") that tax-exempt charitable nonprofits complete and submit to the federal government each year will be accepted by the majority of states, but each state has its own filing requirements.

Click here to learn more about each state's nonprofit tax filing requirements.

Why ExpressTaxExempt?

Other Resources

Recent Videos

Recent Blogs

E-file your Nonprofit Tax Form 990 with our Software

Accurate and Secure Filing

IRS Authorized E-File Provider