Form 1023 An Overview:

In this article we will cover the following points:

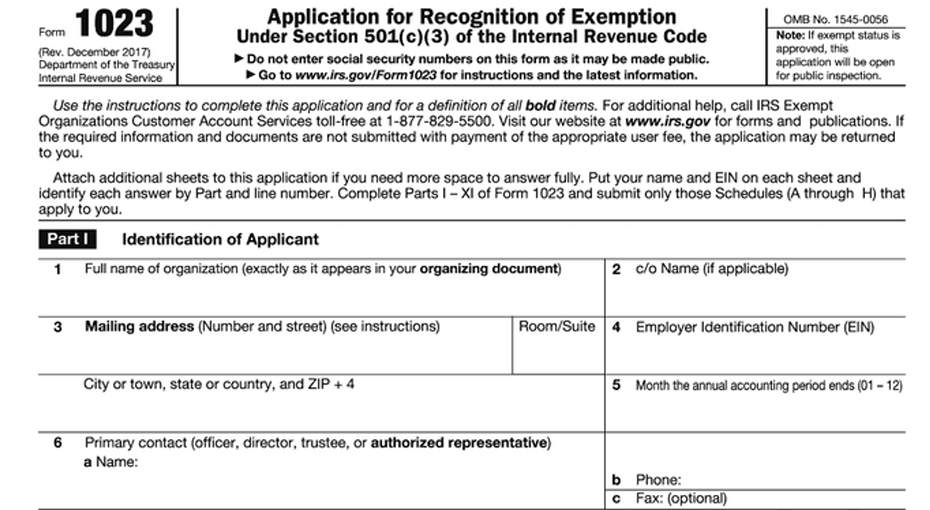

IRS Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) - An Overview

- Updated April 21, 2023 - 8.00 AM - Admin, ExpressTaxExemptForm 1023 is used to apply 501(c)(3) tax exemption from the federal income tax.

Exempt Organizations should file Form 1023 within 27 months from the end of the month after the organization was formed.

The following topics cover everything you need to know about Form 1023, and other related information.

Table of Content

1. What is IRS Form 1023?

Organizations use form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, to apply for recognition of exemption from federal income tax under Section 501(c)(3).

2. What is the purpose of filing Form 1023?

The main purpose of filing Form 1023 is to acquire 501(c)(3) tax exemption from the IRS.

There are two key requirements for an organization to be exempt from federal income tax under section 501(c)(3). They are

- Organized as a corporation, trust, or an unincorporated association, with its organization document defining the organization's purpose(s). The organization must also permanently dedicate its assets to exempt purposes, and

- Operated to further one or more of the exempt purposes stated in its organization document.

3. Who needs to file Form 1023?

Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (LLCs), unincorporated associations and trusts can file Form 1023.

The following organizations are eligible to file Form 1023 under section 501(c)(3) of the Internal Revenue Code:

- Religious or charitable organizations

- Scientific organizations and organizations that test for public safety

- Literary or educational organizations

- National or international amateur sports competitors

- Organizations created to prevent cruelty to children or animals

There are several other types of organizations that are eligible to apply for tax-exempt status. These include organizations categorized as section 501(e) and (f) cooperative service organizations, section 501(k) child care organizations, and section 501(n) charitable risk pools.

4. When to file Form 1023?

Generally, an organization may be recognized as tax-exempt from the date of its formation only if the section 501(c)(3) application for tax exemption is filed and approved within 27 months from the end of the month after the organization was formed.

If a Form 1023 is filed more than 27 months after the organization was formed, the tax-exempt status may only be acknowledged after the actual filing date.

However, exceptions may apply depending on the organization filing late and questions mandating exceptions from the rule.

5. How to apply for 501(c)(3) status?

To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, the organization must file Form 1023 with the IRS.

Click here, to know more about applying for Tax Exempt status.

6. How to file Form 1023 electronically?

The IRS requires that Form 1023 applications for recognition of exemption be submitted electronically online at Pay.gov.

To file Form 1023 electronically, follow the steps below.

1. Register for an account on Pay.gov.

2. Enter "1023" in the search box and select Form 1023.

3. Complete the form.

7. What information is required to file Form 1023?

Form 1023 requires the following information.

- Date the organization was formed and what country it was created under.

- Primary contact name (officer, director, trustee, or authorized representative).

- Organizational structure.

- Organizing documents (e.g., articles of incorporation, trust agreement, articles of association).

- Description of organization's past, present, and future activities.

- Compensation of the organization's officers, directors, trustees, employees, and independent contractors.

- Other members and individuals receiving benefits.

- Organization's history, including whether the organization is the successor of another.

- Specific activities as outlined in the form, including any fundraisers.

- Financial data for the past four years.

8. Additional Information required to file Form 1023

Organizations that qualify for Tax-Exempt under section 501(c)(3) must provide additional information when filing Form 1023 through various schedules.

There are around 8 Schedules available to provide more information about the organization.

Don’t miss attaching the required schedules; it may result in an incorrect filing.

- Schedule A - Church Organizations

- Schedule B - Schools, Colleges, and Universities

- Schedule C - Hospitals and Medical Research Organizations

- Schedule D - Supporting Organizations

- Schedule E - Effective Date

- Schedule F - Low Income Housing

- Schedule G - Successors to Other Organizations

- Schedule H - Organizations Providing Scholarships, Fellowships, Educational Loans, or Other Educational Grants to Individuals and Private Foundations Requesting Advance Approval of Individual Grant Procedures