IRS Form 990 Schedule E Instructions

This article further explores the following points:

Form 990/990-EZ Schedule E - Schools

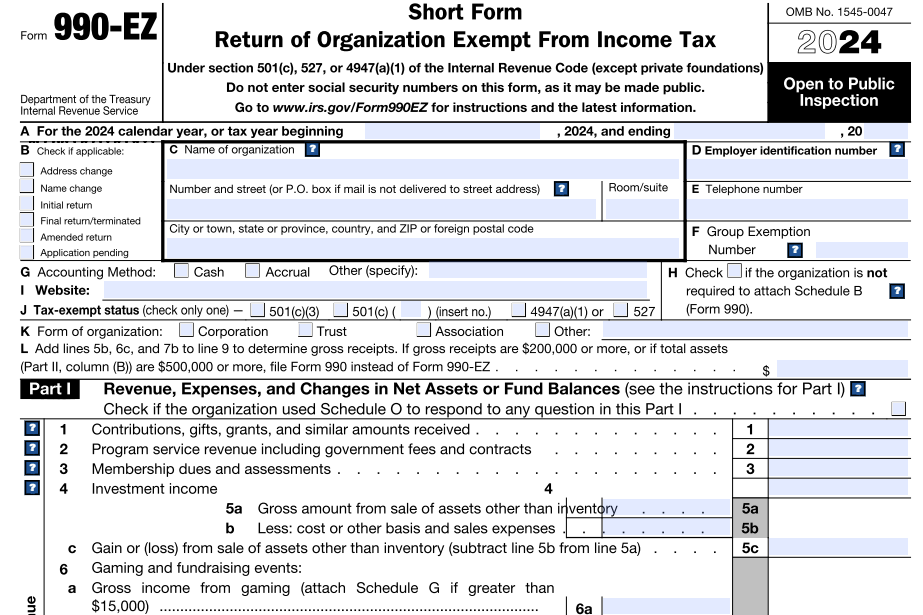

- Updated December 06, 2024 - 6.00 PM - Admin, ExpressTaxExemptSchedule E is used by organizations that file Form 990 or Form 990-EZ to report certain information on private schools.

Table of Contents

1. Who Must File Schedule E?

An organization that answered “Yes” to line 13, Part IV Form 990 or to line 48, Part VI 990-EZ must complete and attach Schedule E. The organization that made response as “Yes” indicates that it checked the box on Schedule A (Form 990/990-EZ), Public Charity Status and Public Support, Part I, line 2, because it’s a school.

In need of additional space, both Form 990 and 990-EZ fillers can use Part II, Supplemental Information of the schedule to provide additional information that needs to be reported.

2. Instruction to Complete Part I of Form 990/990-EZ Schedule E

Part I is used by organizations to provide information about the racially nondiscriminatory policy, educational policies, admission policies, faculties, financial assistance, scholarships, and all catalogues.

The organization must satisfy the following requirements while filing Schedule E along with IRS Form 990/990-EZ:

Organizational requirements - In general, every school must contain a statement defining its charter, bylaws, or other governing instruments, or in a resolution of its governing body. The purpose of this statement is to have a nondiscriminatory policy to avoid discrimination against applicants and students based on race, color, and national or ethnic origin.

Statement of policy - Every school must include the statement of its racially nondiscriminatory policy in all the brochures and catalogues that are related to student admissions, programs, and scholarships. The purpose of this process is to make these policies easily available for the students. The statement that is similar to the Notice described in paragraph (a), subsection 1, section 4.03 (Publicity), below, will be acceptable for this purpose.

Also, the schools are required to include a reference to its racially nondiscriminatory policy through various written advertisements as a means of informing prospective students of its programs. These other references made will be accepted by the school, provided it satisfies the purpose.

Publicity - The school must take the necessary steps to make its racially nondiscriminatory policy known to all segments of the general community served by the school.

To make the policies well aware with all the general community served by the school, the school must use any one of the following methods described to satisfy the requirement:

A. The school may publish a notice of its racially nondiscriminatory policy in a newspaper and make it as a general circulation so that it serves all racial segments of the community. In case, if more than one community is served by the school, the school may publish the policies in the form of notice in the papers that are most commonly read by all the racial segments of the communities that serve under them.

Also, the notice that is to appear in the newspaper must occupy at least three column inches and must be captioned in at least 12-point boldface type with the text printed in at

least 8-point type.

B. The school can make use of the broadcast media to publicize its nondiscriminatory policy to all the segments of the general community served by the school. If this method is chosen out of the 3 methods for the purpose of publicity, then the school must provide the required documentation that satisfies the purpose of publicity.

C. The school may display a notice of its racially nondiscriminatory policy on its primary publicly accessible Internet homepage at all times during its tax year. The notice that is made public by this process is acceptable. In case if the school does not possess its own website but only has some related webpages on a website, then it can display its racially nondiscriminatory policy on the landing page of that website to satisfy the publicity requirement.

Facilities and programs - Every program and facility run by the school must reflect the programs and facilities conducted abide by the racial nondiscriminatory policy.

S6cholarship and loan programs - Scholarships and other benefits offered for the applicants and the students must be provided based on a racially nondiscriminatory basis. The availability of these benefits must be made public throughout the general community served by the school.

The scholarships and loans that are made through financial assistance programs generally benefit the members of one or more racial minority groups. They are designed to promote the school’s racially nondiscriminatory policy and won’t affect the school’s exempt status.

Financial assistance programs benefit the members of one or more racial groups. The programs are made in such a way that they don’t significantly deviate from the school’s racially nondiscriminatory policy and won’t affect the school’s exempt status.

Certification - A school that claims to be racially nondiscriminatory is required to satisfy the applicable requirements of sections 4.01 through 4.05, Rev. Proc. 75-50. In that case, an individual with the authority make decisions on behalf of the school is required to certify annually, under penalties of perjury, that to the best of his or her knowledge and belief the school has satisfied the applicable requirements of sections mentioned above. This certification is mentioned in line 7, Part I of the Schedule.

Faculty and staff - In general, the existence of a racially discriminatory policy for employees of a faculty is significant to the racially discriminatory policy as to the students. This significance is the same for the absence of a racially discriminatory policy for the employees of the faculty as well as to the students.

Specific Records - Every private school under tax-exemption must maintain their records for a minimum period of 3 years for the IRS.

Here is the list of records that needs to be maintained:

1.Records that specify the racial composition of the student body, faculty, and administrative staff for each academic year

2.Records that contain witness documents stating that the scholarship and other financial assistance is provided to the students on a racially nondiscriminatory basis

3.Copies of all brochures, catalogues, and advertising dealing with student admissions, programs, and scholarships.

4.Copies of all materials used by or on behalf of the school to solicit contributions

Limitation

1. The information on the racial composition of the student body, faculty, and administrative staff obtained from Specific Records is easily estimated by the school without the need of student applicants, students, faculty, or administrative staff to submit information to the school. For each academic year, however, a record of the method by which racial composition is determined must be maintained.

2. The IRS doesn’t require the school to release personally identifiable records or personal information contained therein except in accordance with the requirements of the Family Educational Rights and Privacy Act of 1974, 20 U.S.C. section 1232(g) (1974). Similarly, the IRS doesn’t require the school to keep records of the maintenance of which is prohibited under state or federal law.

Exceptions

The records described under Specific Records need not be independently maintained for IRS use if:

1. The information maintained in the records has already been included in report or reports filed in accordance with the law with an agency or agencies of federal, state, or local government within the current year; and

2. The school maintains copies of these reports from which the information is readily available. However, if the records maintained under Specific Records were not included in reports filed with an agency or agencies, then it is the duty of the school to maintain those records for the IRS use.

Failure to maintain records

If the organization failed to maintain or produce the records, upon request, then the information and the records not produced will result in creating an assumption that the organization has failed to comply with the guidelines stated.

3. Instruction to Complete Part II of Form 990/990-EZ Schedule E

Part II - Supplemental Information

Part II of the schedule is generally used by organizations to provide the narrative explanations required, if applicable, to supplement responses to Part I, lines 3, 4d, 5h, 6b, and 7. While using the part, identify the specific line number that each response supports, in the order in which those lines appear on the Schedule (Form 990 or IRS Form 990-EZ).

Also, the part can be duplicated by both IRS Form 990 and 990-EZ fillers in need of additional space to provide additional explanation.

4. Choose ExpressTaxExempt to file your Form 990 with Schedule E

When you file Form 990-EZ or IRS Form 990, the application will automatically generate Schedule E based on the information you provide on the form.

Our Software will validate the information you provide before transmitting to the IRS and allows you to correct the errors if any. This will avoid rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.

5. Article Sources