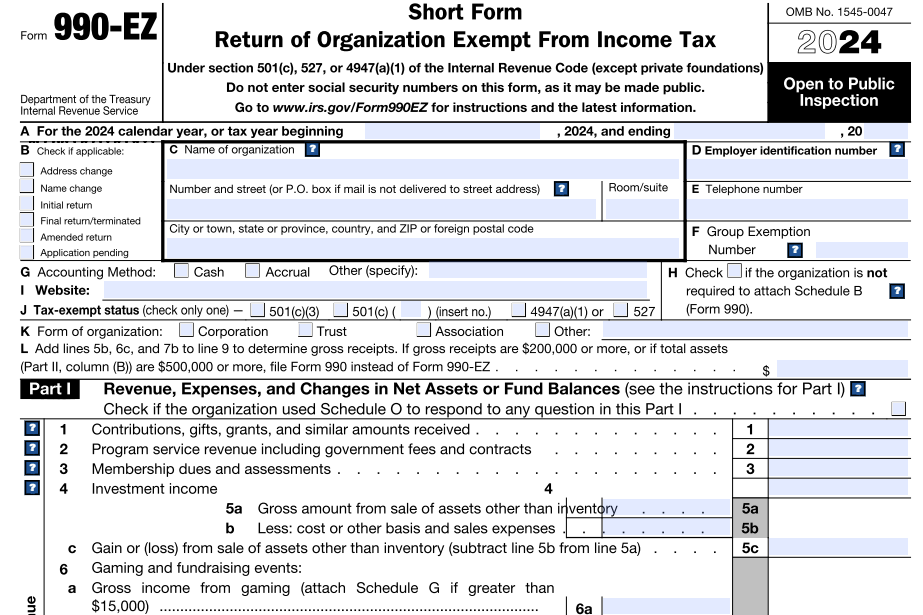

IRS Form 990 Schedule J Instructions

This article further explores the following points:

IRS Form 990 Schedule J - Overview

- Updated December 06, 2024 - 8.00 AM - Admin, ExpressTaxExemptNonprofits and Tax-Exempt Organizations that file Form 990 use this schedule to provide required information about Compensation.

Table of Contents

1. What is IRS Form 990 Schedule J?

2. Who must File Form 990 Schedule J?

3. Instructions on Form 990 Schedule J

Part I - Questions Regarding Compensation

Part II - Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

4. Choose ExpressTaxExempt to file your Form 990 with Schedule J

1. What is IRS Form 990 Schedule J?

Schedule J is used by Nonprofit Organizations that file Form 990 to provide the compensation information for highly compensated employees, officers, directors, individual trustees, key employees. Also, the schedule must contain information on certain compensation practices followed in the organization.

2. Who must File Form 990 Schedule J?

Nonprofits and tax-exempt organizations filing Form 990 and marking "Yes" to line 23 in Part IV, Checklist of Required Schedules must file Schedule J.

3. Instructions on Form 990 Schedule J

Form 990 Schedule J consist of three parts:

- Part I - Questions Regarding Compensation

- Part II - Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

- Part III - Supplemental Information

Part I - Questions Regarding Compensation

Part I of schedule J focuses on certain compensation practices followed in the organization. It is generally related to all officers, directors, trustees, and employees of the organization listed on Form 990, Part VII, Section A, regardless of whether the organization answered “Yes” to line 23 of Part IV for all such individuals.

Part I indicates the travel expenses, reimbursements, amounts paid during the year by the filing organization or related organization (a parent, subsidiary, brother or sister organization under common control), provided any non-fixed payments by the Organization and other compensation details for individuals listed on Form 990, Part VII, Section A.

Part II - Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

Provide the details on Part II of Form 990 Schedule J for certain individuals listed on Form 990, Part VII, Section A. Report compensation for the tax year ending with or within the organization's tax year paid to or earned by the following individuals.

Enter the following information for the listed individual's:

- Name and title

- Base compensation included in box 1 or box 5 (whichever is greater) of Form W-2 or box 7 of Form 1099-MISC issued to the person

- Bonus and incentive compensation included in box 1 or box 5 (whichever is greater) of Form W-2 or box 7 of Form 1099-MISC issued to the person

- All other payments issued to the listed individuals and included in box 1 or box 5 of Form W-2 or box 7 of Form 1099-MISC but not reflected in column (B)(i) or (B)(ii)

- Enter the Retirement and other deferred compensation

- Enter the Nontaxable benefits

- This was mentioned in Schedule J, Part II Column F

Part III - Supplemental Information

Part III can be used to provide any additional information required on

- Part I, Questions Regarding Compensation, lines 1a, 1b, 3, 4a, 4b, 4c, 5a, 5b, 6a, 6b, 7, and 8

- Part II, Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

- Name of the unrelated organization that provided compensation to persons listed in Form 990, Part VII, Section A.

- Type and amount of the compensation paid or accrued by an unrelated organization

- Information on the person who receives or accrues those compensations.

4. Choose ExpressTaxExempt to file your Form 990 with Schedule J

When you file Form 990, the application will automatically generate Schedule J based on the information you provide on the form.

Moreover, the application will validate the information you provide against the IRS business rules and identify the errors beforehand. This will do away with unnecessary rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.