IRS Form 990 Schedule I Instructions

This article further explores the following points:

IRS Form 990 Schedule I Overview

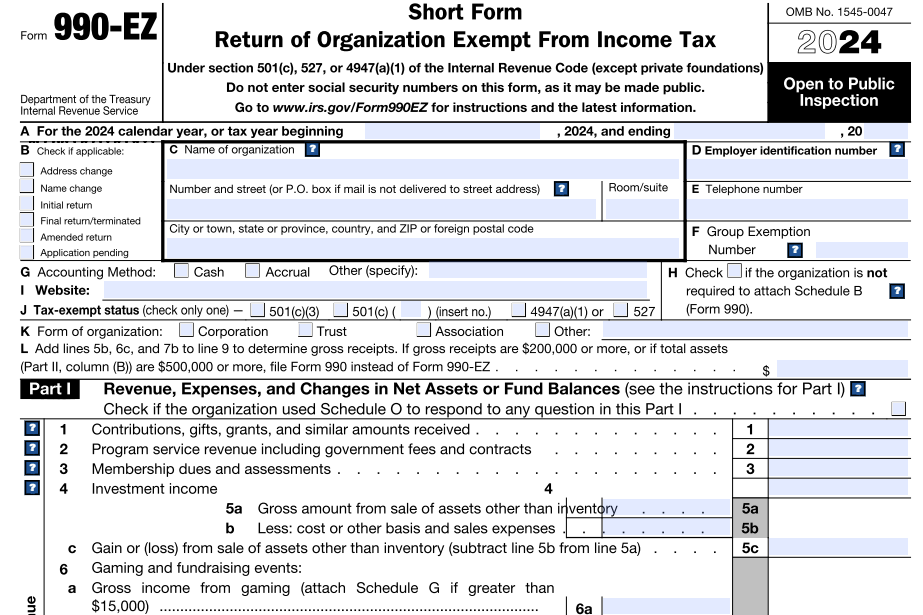

- Updated December 06, 2024 - 6.00 PM - Admin, ExpressTaxExemptNonprofits and Tax-Exempt Organizations that file Form 990 use this schedule to report information on grants and other assistance made for the tax year.

Table of Contents

1. What is IRS Form 990 Schedule I?

2. Who must File Form 990 Schedule I?

3. Instructions on Form 990 Schedule I

Part I - General Information on Grants and Assistance

Part II - Grants and Other Assistance to Domestic Organizations and Domestic Governments

Part III - Grants and Other Assistance to Domestic Individuals

4. Choose ExpressTaxExempt to file your Form 990 with Schedule I

1. What is IRS Form 990 Schedule I?

Form 990 Schedule I is filed by the organizations to report information on grants and other assistance made to

- Domestic Organizations - include a corporation or partnership that is created or organized in the United States.

- Domestic Governments - a state under a US possession, a political subdivision of the state.

- Domestic Individuals - a person including a foreign citizen, who lives or resides in the US.

Also, schedule I is used by an organization to report the activities conducted by it directly and activities conducted indirectly through a disregarded entity or a joint venture treated as a partnership.

Reporting the grants and other assistance also includes:

| Awards | Stipends |

| Prizes | Scholarship |

| Contributions | Fellowship |

| Noncash assistance | Research grants |

| Cash allocation | And any other similar payments and distributions made by the organization. |

2. Who must File Form 990 Schedule I?

Nonprofits and tax-exempt organizations filing Form 990 and marking "Yes" to line 21 or line 22 in Part IV, the Checklist of Required Schedules, must file Schedule I and attach it with

Form 990.

Form 990 Part IV Line 21 - Did the organization report more than $5,000 of grants or other assistance to any domestic organization or domestic government on Part IX, column (A), line 1?

If “Yes,” complete Schedule I, Parts I and II

Form 990 Part IV Line 22 - Did the organization report more than $5,000 of grants or other assistance to or for domestic individuals on Part IX, column (A), line 2?

If “Yes,” complete Schedule I, Parts I and III

3. Instructions on Form 990 Schedule I

Form 990 Schedule I consist of four parts:

- Part I - General Information on Grants and Assistance

- Part II - Grants and Other Assistance to Domestic Organizations and Domestic Governments

- Part III - Grants and Other Assistance to Domestic Individuals

- Part IV - Supplemental Information

Part I - General Information on Grants and Assistance

Part I must be completed by the organization if they have answered “Yes” on Form 990,

Part IV line 21, or line 22.

Part I indicates whether an organization has maintained the records to substantiate amounts, eligibility, and selection criteria used for the grants. In general, the filing organization must describe how it monitors and tracks its grants and ensure that the grants are used for a proper purpose and have not deviated from its intended purpose.

The organization has to explain the reports required or field investigations conducted under part IV of Form 990 Schedule I.

Part II - Grants and Other Assistance to Domestic Organizations and Domestic Governments

Part II must be completed by the organizations that answered “Yes” on Form 990 Part IV line 21 to report the grants made to each domestic organization or government.

Part II lists the information about each recipient (Domestic Organizations and Domestic Governments) which has received more than $5,000 in grants or assistance for the tax year.

Part II requires the grant and assistance details along with the details of the domestic organization or government such as

- Name and address - Legal name and Mailing Address of each recipient organization or government entity.

- EIN - Employer Identification Number of the recipient.

- IRC section - The section of the organization under which it has received the tax-exempt status.

- Amount of cash grant - the total amount of cash grants made to each recipient organization or government entity for the tax year. It also includes the grants and allocations paid by cash, check, money order, and electronic funds or wired transfer.

- Amount of non-cash assistance - Requires the fair market value of the non-cash assistance. The organization can use an appraised or estimated value when the fair market value can’t be determined.

- Method of valuation - Describe the method of Valuation for non-cash assistance (Book, FMV, appraisal, other).

- Description of noncash assistance - Describe the property or assistance for the noncash grants and assistance that includes any medical supplies or any educational supplies.

- Purpose of grant or assistance - Describe the purpose of grants and other assistance. Part IV can be used in case additional space is required.

Part III - Grants and Other Assistance to Domestic Individuals

Part III must be completed by the organization that answered "Yes" on Form 990, Part IV line 22.

Part III must be completed only when the grants and other assistance are made to individual recipients. Part III lists the information about each individual who received more than $5,000 in grants or assistance for the tax year.

Enter the details of each grant and assistance to the individuals on a separate line. If any additional space is required for descriptions, Part IV can be used.

- Type of grant or assistance - Specify the type of grants and assistance and describe its purpose. Use direct and specific descriptions such as scholarships, educational supplies, food, clothing, and shelter or any direct cash assistance. If there is any specific assistance for disaster include that.

- Number of recipients - For each type of assistance, enter the number of recipients. If the organization is unable to find the actual number, an estimated number can be provided. The explanation for the estimated number must be explained in Part IV.

- Amount of cash grant - the total amount of cash grants made to each recipient organization or government entity for the tax year. It also includes the grants and allocations paid by cash, check, money order, and electronic funds or wired transfer.

- Amount of non-cash assistance - Requires the fair market value of the non-cash assistance. The organization can use an appraised or estimated value when the fair market value can’t be determined.

- Method of valuation - Describe the method of Valuation for non-cash assistance (Book, FMV, appraisal, other).

- Description of noncash assistance - Describe the property or assistance for the noncash grants and assistance that includes any medical supplies or any educational supplies.

Part IV - Supplemental Information

Part IV can be used to provide any additional information required on

- Part I, regarding the monitoring of the funds

- Part II regarding the explanations of fair market values, method of values, and explanation of non cash assistance

- Part III regarding how the organization estimates the number of recipients for each type of grant and non-cash assistance and the method of value

4. Choose ExpressTaxExempt to file your Form 990 with Schedule I

When you file Form 990, our software will automatically generate Schedule I based on the information you provide on the form.

Moreover, the application will validate the information you provide against the IRS business rules and identify the errors beforehand. This will do away with unnecessary rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.