Form 8038-CP Mailing Address

In this article we will cover the following points:

Where to mail IRS Form 8038-CP

- Updated April 21, 2023 - 5.00 PM Admin, ExpressTaxExemptBefore we discuss the Form 8038-CP mailing address, it's important to understand the purpose of the form, the due date, and the benefits of filing Form 8038-CP electronically.

Table of Content

1. Purpose of Form 8038-CP

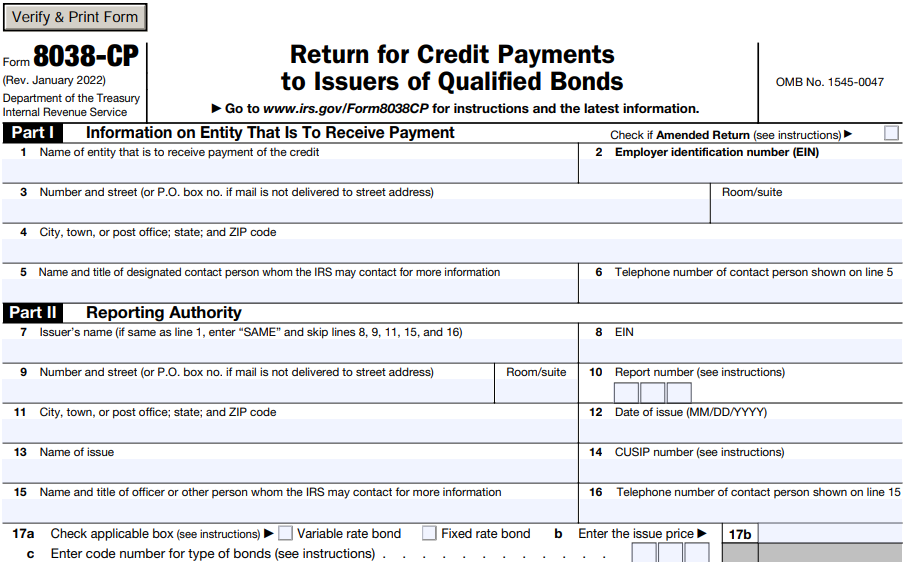

Tax-exempt organizations and government entities use Form 8038-CP to request a direct payment from the federal government equal to a percentage of the interest payments on the following bonds:

- Build America bonds (BAB)

- New clean renewable energy bonds (NCREB)

- Qualified energy conservation bonds (QECB)

- Qualified zone academy bonds (QZAB)

- Qualified school construction bonds (QSCB)

- Recovery zone economic development bonds (RZEDB)

Click here to learn more about Form 8038-CP and its filing instructions.

2. Form 8038-CP Deadline

The due date to file Form 8038-CP varies depending on the bond rates:

- Fixed Rate Bonds: No later than 45 days before the relevant interest payment date (or) earlier than 90 days before the relevant interest payment date.

- Variable rate bonds: when the issuer knows the interest payment amount 45 days prior to the interest payment date, 8038-CP Form may be filed within the same timelines as fixed rate bonds (45 days before the relevant interest payment date but no earlier than 90 days before the relevant interest payment date). However, a separate Form 8038-CP should still be filed for the variable rate bonds.

3. Advantages of E-Filing Form

8038-CP

There are several advantages of e-filing Form 8038-CP compared to paper filing. The IRS began supporting e-filing of form 8038-CP in May of 2023 to encourage filers to e-file their credit return for easy processing.

Benefits of e-filing:

- Secure and accurate filing

- Returns are processed more quickly

- Get updates on the status of your return

- Avoid manual calculation errors

Get Started with an IRS-authorized e-filing provider like ExpressTaxExempt to

file your Form 8038-CP accurately and securely.

4. Mailing Address of Form 8038-CP

IRS Form 8038-CP paper returns must be sent to the following address.

Internal Revenue Service Center,

Ogden, UT 84201-0050.

Note: Paper filers can use private delivery services (PDS) for timely filing.

Learn More