Form 8038-CP Filing Instructions

In this article we will cover the following points:

An Overview of IRS Form 8038-CP

- Updated April 21, 2023 - 8.00 AM - Admin, ExpressTaxExemptTable of Contents

1. What is IRS Form 8038-CP?

IRS Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds, is used to claim refundable tax credits payable to issuers of:

- qualified build America bonds (BABs)

- recovery zone economic development bonds (RZEDBs) under sections 54 AA, 1400U-2, and 6431 of the Internal Revenue Code

- specified tax credit bonds (STCBs) under Code sections 54A and 6431(f)

2. Who must file Form 8038-CP?

Issuers of qualified build America bonds (BABs), recovery zone economic development bonds (RZEDBs), and specified tax credit bonds must complete and file their IRS Form 8038-CP to request the credit payments payable under the Acts.

3. What are the types of Bonds associated with Form 8038-CP?

The various bonds associated with Form 8038-CP include:

- Build America bonds (BAB)

- New clean renewable energy bonds (NCREB)

- Qualified energy conservation bonds (QECB)

- Qualified zone academy bonds (QZAB)

- Qualified school construction bonds (QSCB)

- Recovery zone economic development bonds (RZEDB)

4. When is the due date to file Form

8038-CP?

Form 8038-CP doesn’t have a specific due date.

However, filing Form 8038-CP for fixed rate bonds must be filed no later than 45 days before the relevant interest payment date (IPD). It may not be submitted earlier than 90 days before the IPD.

For example, If you are filing Form 8038-CP for a fixed rate bond and the Interest Payment Date is 01/15/2024, the due date of the return is 45 days before the IPD, which is December 2, 2023.

The filing timeline is the same for variable rate bonds (45 days before the relevant interest payment date but no earlier than 90 days before the relevant interest payment date).

For variable rate bonds when the issuer does not know the interest payment amount 45 days prior to the interest payment date, the issuer must aggregate all credit payments every quarter and file Form 8038-CP for reimbursement in outstanding payments no later than 45 days after the last interest payment date within the quarterly period for which the reimbursement is being requested.

For example, if you are filing IRS Form 8038-CP for a variable rate bond and the Interest Payment Date (IPD) on line 18 is 01/15/2024, the due date of the return is 45 days after the last lPD within the quarterly period for which the reimbursement is being requested, which is March 1.

5. How to file Form 8038-CP?

Form 8038-CP can be filed with the IRS electronically or by sending a paper copy.

The IRS encourages the issuers to file 8038-CP electronically. By E-filing, the IRS can process the 8038-CP returns more quickly, and you will receive updates regarding the status of your return.

If you choose to file Form 8038-CP by paper, you will need to download the form, fill in the necessary details, and mail form 8038-CP to the address mentioned below

Internal Revenue Service Center,

Ogden, UT 84201-0050.

6. Instructions to file Form 8038-CP

The instructions provided below will help you complete the filing process of Form 8038-CP.

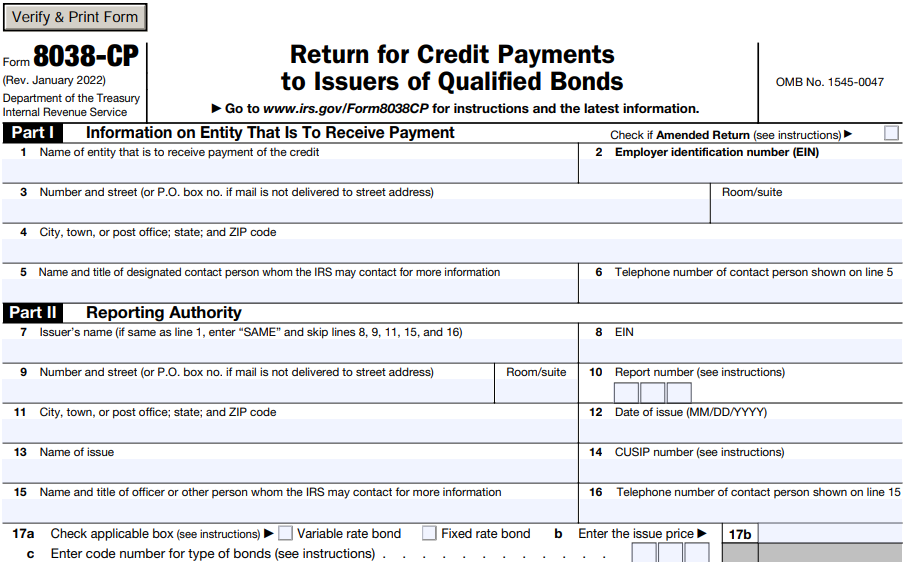

Instructions to complete Form 8038-CP Part I - Information on Entity That Is To Receive Payment

Line 1-6 requires basic organization information. Enter the following details in lines 1 - 6 of Form 8038-CP

- Name of the organization

- Employer identification number (EIN)

- Organization Address

- Name and title of designated contact person

- Telephone number of designated contact person

Instructions to complete Form 8038-CP Part II - Reporting Authority

Form 8038-CP Part II requires information about the issuer. This part should be completed in full if the issuer is authorized by the IRS to pay the requested refundable credit payment to another entity on its behalf (for example, a trustee bank).

*If the issuer’s name is the same as line 1, enter “SAME” in line 7 and skip lines 8, 9, 11, 15, and 16 of Part II.

Instructions to complete Form 8038-CP Part III - Payment of Credit

Form 8038-CP Part III requires information about credit payment. If there are specified tax credit bonds with multiple maturities, refer to IRS Form 8038-CP for further instructions.

Direct Deposit

In line 26, enter the following information regarding direct deposit

- Routing number

- Type - Checking or Savings type

- Account number

Signature and Consent

The issuer is responsible for signing Form 8038-CP with their name, title, and filing date.

Paid Preparer Use Only

The person who prepares the 8038-CP return must sign the return, list the preparer's taxpayer identification number (PTIN), and fill in the other details like the Firm's Name, address, EIN, and phone number.

7. Any additional requirements when filing 8038-CP?

While filing 8038-CP form, the issuers may need to attach Schedule A along with their 8038-CP return.

Schedule A for Form 8038-CP is used to compute the amount of the refundable credit payment allowed under section 6431(f) and must be completed for all specified tax credit bonds, which are new clean renewable energy bonds (NCREBs), qualified energy conservation bonds (QECBs), qualified zone academy bonds (QZABs), and qualified school construction bonds (QSCBs).

8. What are the penalties for filing Form 8038-CP late?

Form 8038-CP doesn't have any late filing penalties. However, for paying back arbitrage (or paying the penalty instead of arbitrage rebate) to the federal government, use Form 8038-T, Arbitrage Rebate, Yield Reduction and Penalty instead of Arbitrage Rebate.

9. Where to mail Form 8038-CP?

Complete and Mail IRS Form 8038-CP to

Internal Revenue Service Center,

Ogden, UT 84201-0050.