E-file Form 990-EZ Online

Our easy-to-use software helps nonprofits streamline 990-EZ e-filing with exclusive features to maintain their tax-exempt status.

Why E-File Form 990-EZ with ExpressTaxExempt?

- Includes 990-EZ Schedules for Free

- Form-Based or Interview Style Filing

- Free First Amendment for original return filed with us.

- Retransmit Rejected Returns for FREE

- Supports Form 990-T to report unrelated business tax

- Phone, Email, & Live Chat Support

View Pricing

Form 990-EZ: Key Insights

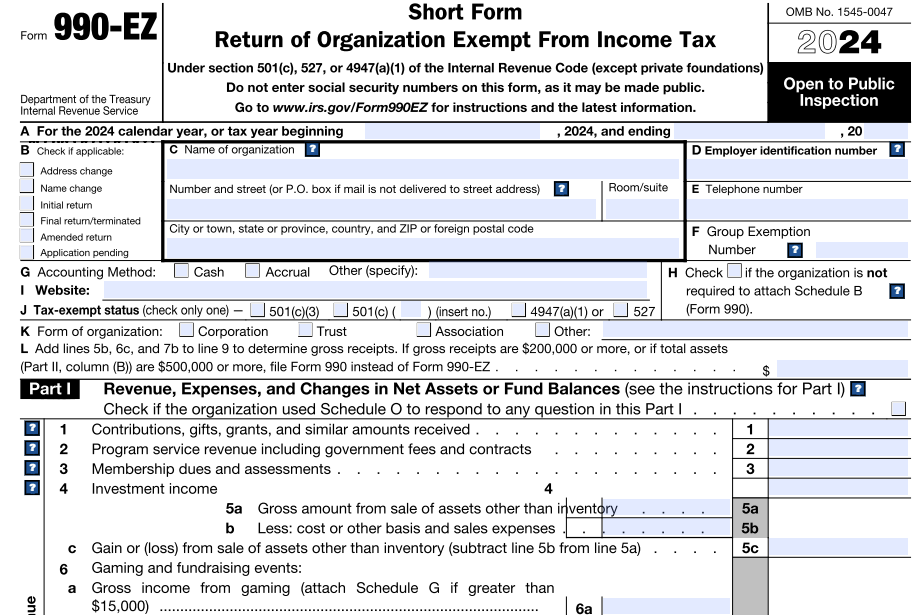

Form 990-EZ should be filed annually by tax-exempt organizations whose gross receipts are less than $200,000 and total assets are less than $500,000 to report their income, expenses, and other activities.

It should be filed on or before the 15th day of the 5th month following the close of the organization’s tax year.

Why E-file Form 990-EZ Online with ExpressTaxExempt?

Free Schedules

Just pay for your 990-EZ form and get all the necessary schedules automatically included at no additional cost.

Flexible Filing Options

Enter the data directly onto the form (form-based) or answer a series of questions to generate your form (interview-based).

Copy Data Option

If you have a prior year 990-EZ filed with us, you can copy the data onto your current year's return, even if the previous year's return was filed elsewhere.

Internal Audit

Let our system audit your 990-EZ for common IRS errors before transmission, reducing the chances of rejections.

8868 Extension

Need more time to file your 990-EZ? E-file 8868 with us and get a 6-month automatic extension.

Customer Support

Our support team has your back throughout the filing process via live chat, phone, and email.

Exclusive PRO Features

Our software incorporates certain exclusive features tailored to simplify the filing process for Paid Preparers and Electronic Return Originators (EROs).

Team Management

Grant access to your team members, assign them roles, and let them manage the 990-EZ filings on your behalf.

Reviewers and Approvers

Share your completed 990-EZ returns with the respective organization’s higher authorities for their review/approval.

Bulk Upload

Eliminate the hassles of manual entry by using our Excel templates to upload certain form data.

File Form 990-EZ Easily with our Amazing Features

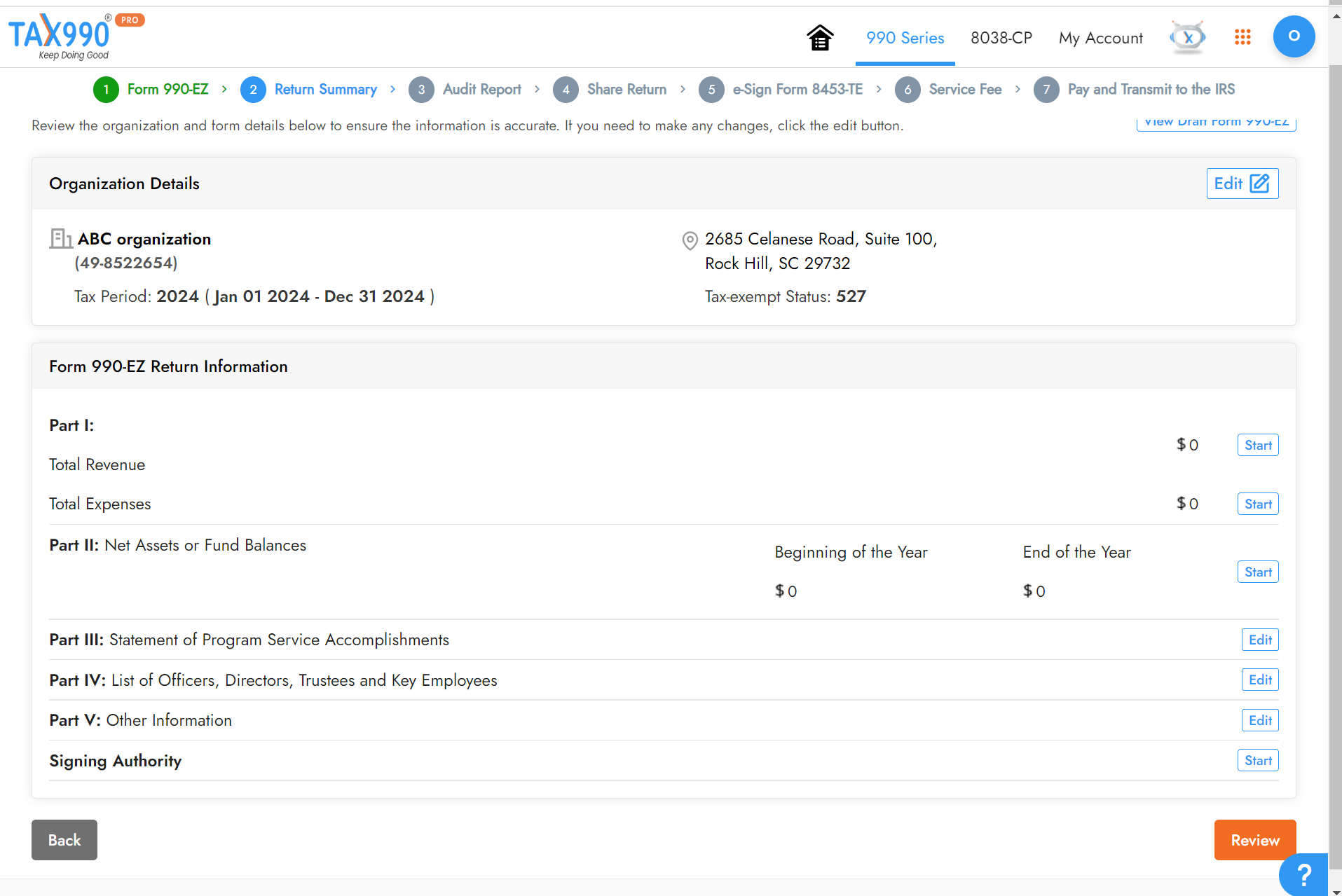

How to E-file Form 990-EZ Online for the 2024 Tax Year

with ExpressTaxExempt?

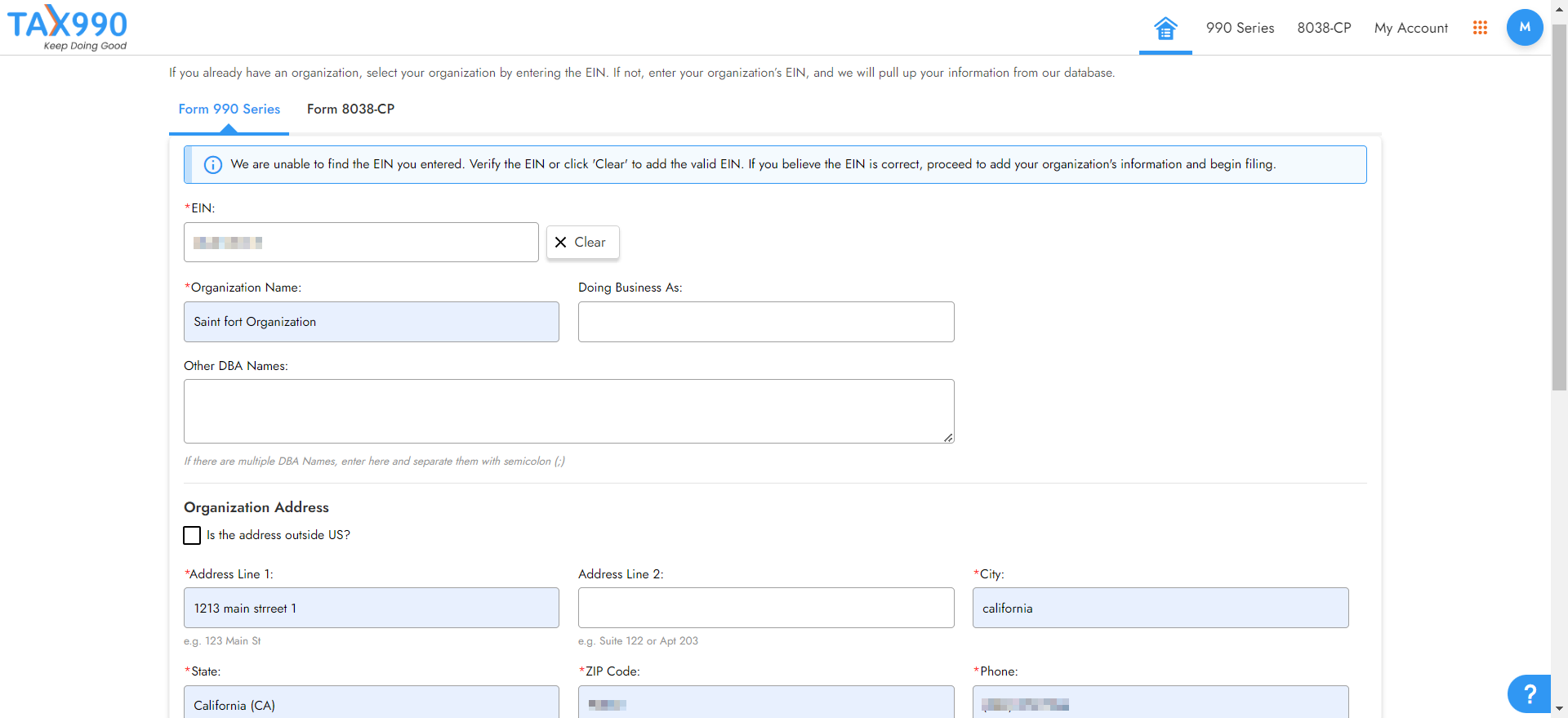

Search for your EIN, and our system will import your organization’s data from the IRS database. You can also enter your organization’s details manually.

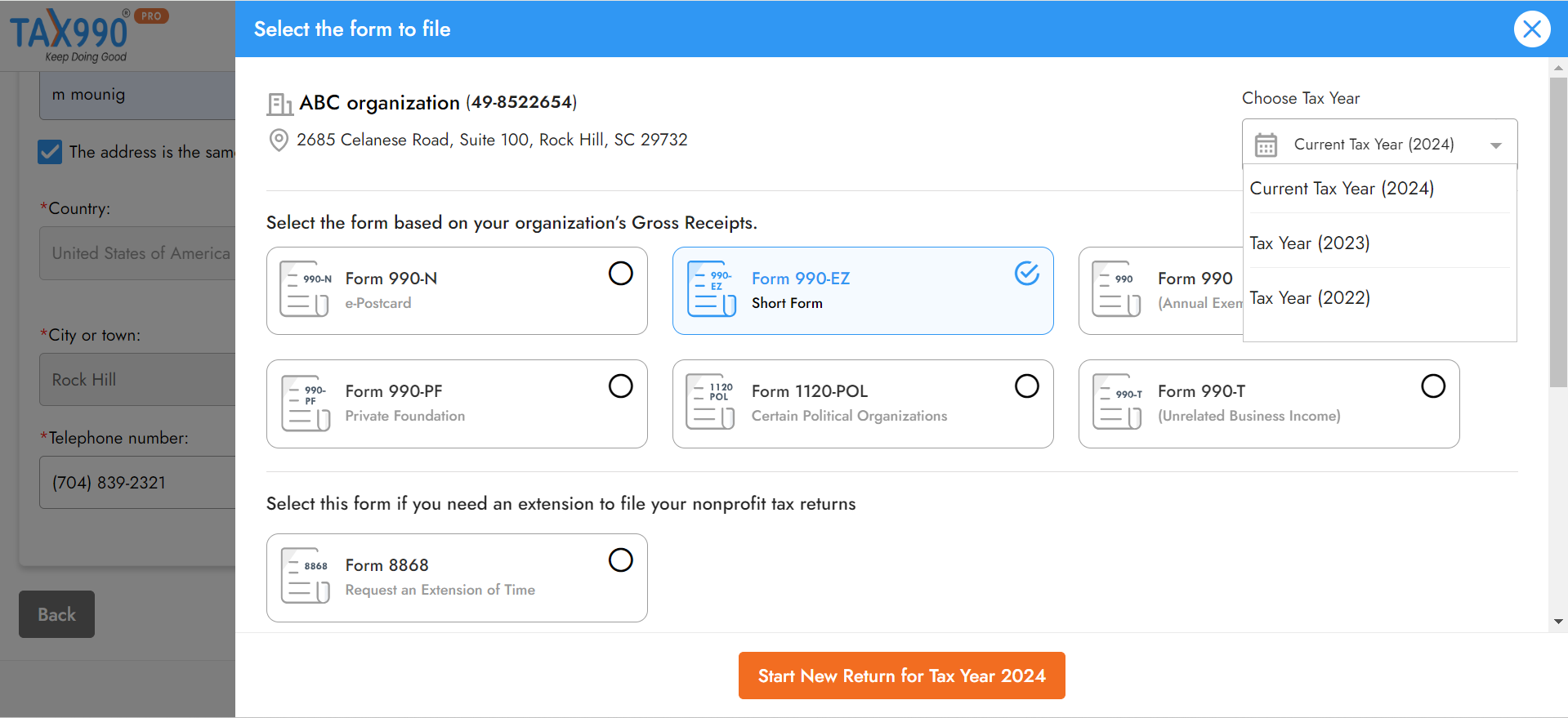

Choose the tax year for which you want to file a return and proceed. ExpressTaxExempt supports the current and the previous year's filing.

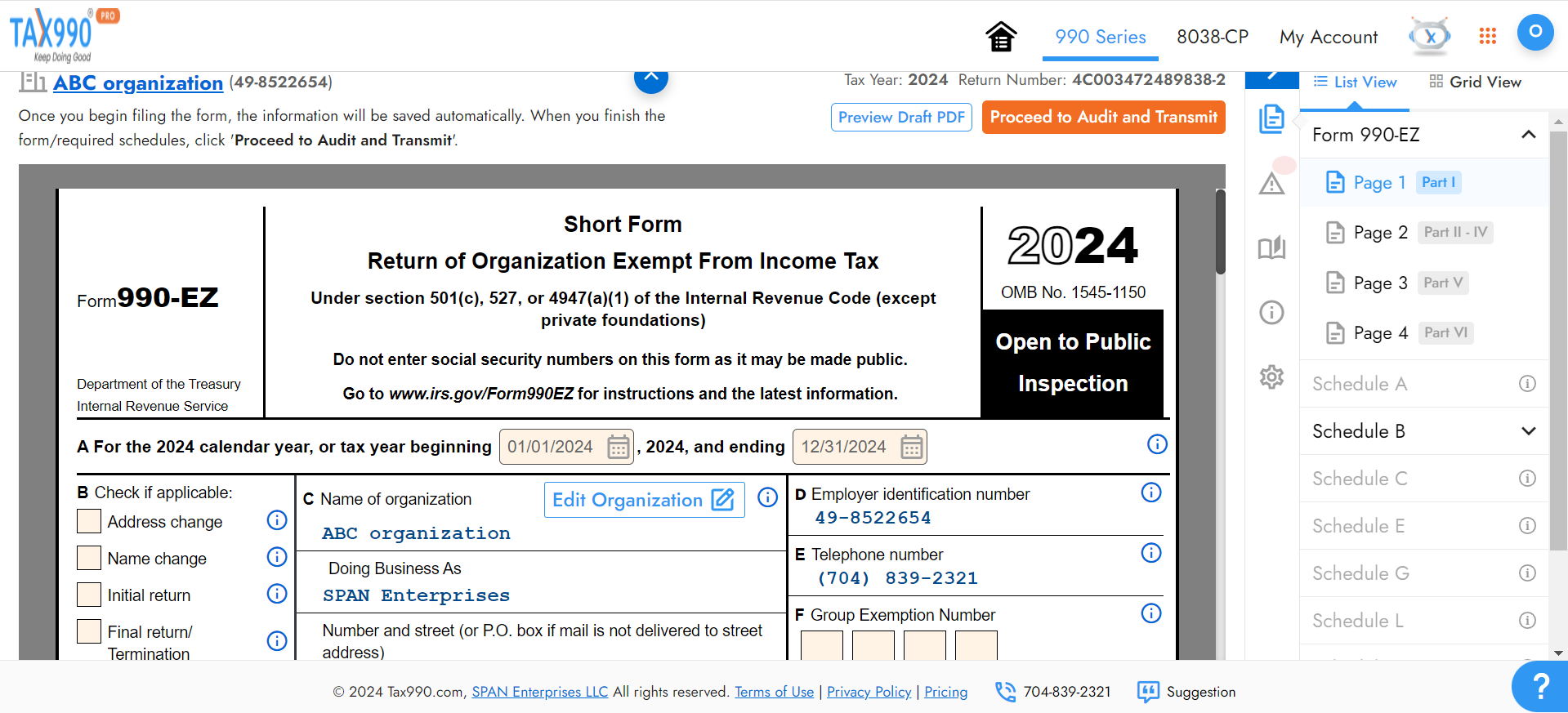

We provide a Form-based and Interview-Style filing option for 990-EZ. Choose your preferred method and provide the required form information.

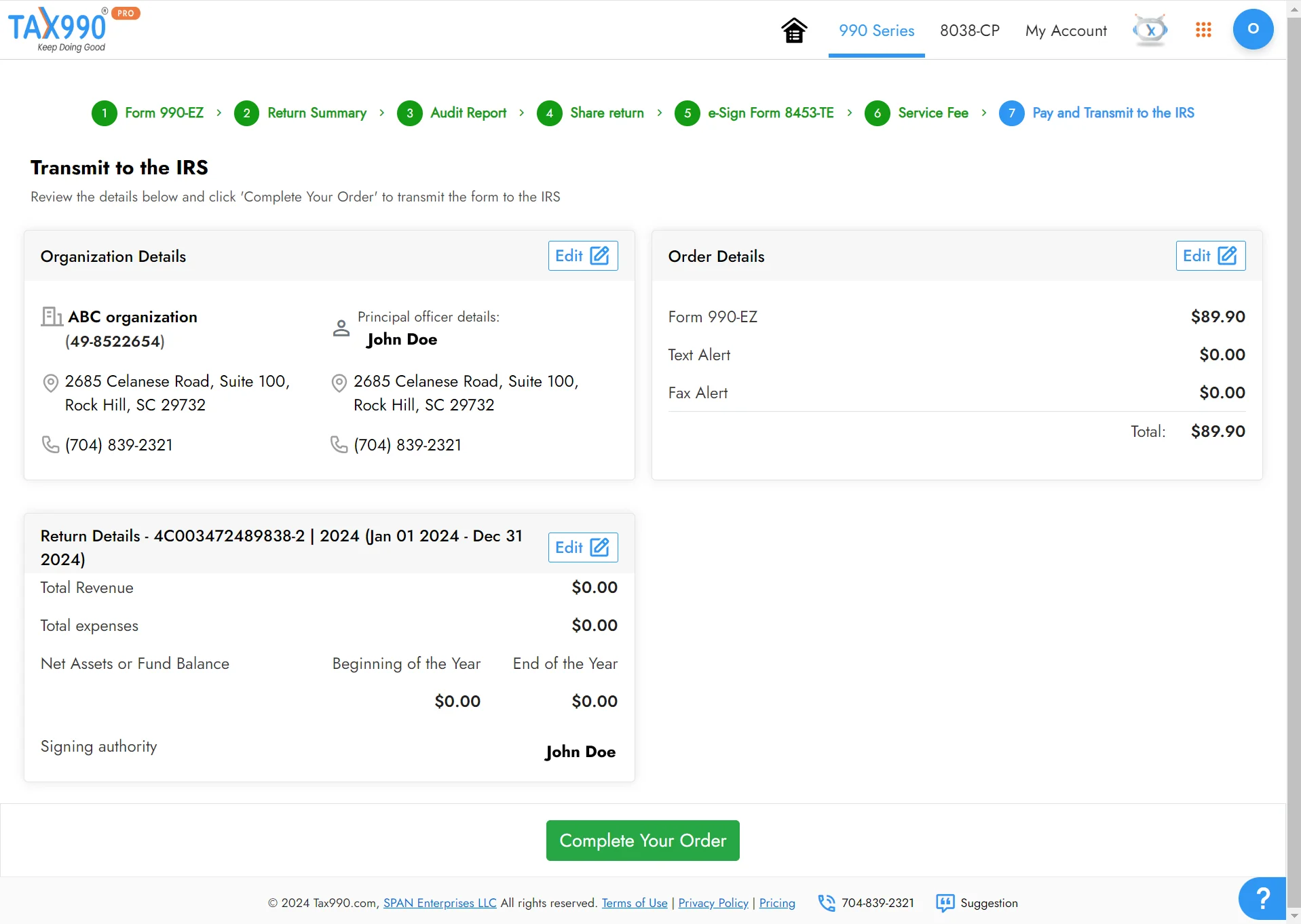

You can review the summary of your form. Also, you can share your form with other organization members to review and approve the return.

Once you have reviewed the form, you can transmit it to the IRS. Our system keeps you updated with the status of your form via email and text.

Ready to File Your Form 990-EZ Electronically?

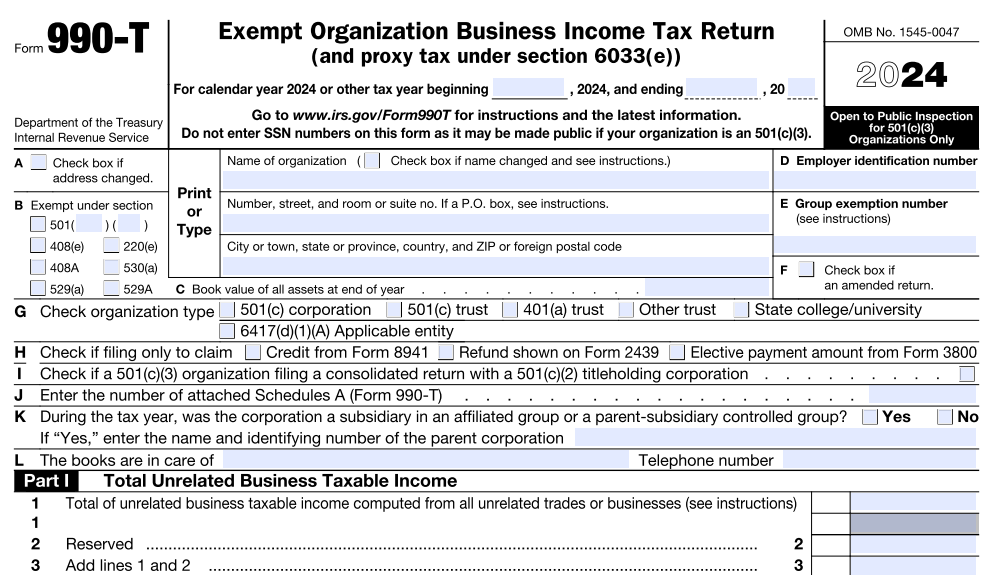

Reporting Unrelated Business Income on Form 990-T

Organizations that file 990-EZ must also file Form 990-T if their total unrelated business income exceeds $1000 or more during the corresponding tax year.

In addition to 990-EZ, ExpressTaxExempt also supports the e-filing of Form 990-T. Learn More

Supported Schedules for Form 990 EZ

There are 8 Schedules applicable to 990-EZ, and you must attach the required ones based on the data you enter.

- Schedule A (Public Charity Status and Public Support)

- Schedule B (Schedule of Contributors)

- Schedule C (Political Campaign and Lobbying Activities)

- Schedule E (Schools)

- Schedule G (Supplemental Information Regarding Fundraising or Gaming Activities)

- Schedule L (Transactions With Interested Persons)

- Schedule N (Liquidation, Termination, Dissolution, or Significant Disposition of Assets)

- Schedule O (Supplemental Information to Form 990 or 990-EZ)

Form 990-EZ Schedules

In addition to Form 990-EZ, you may need to attach a few Schedules to elaborate on certain information you reported on your main form.

If you choose ExpressTaxExempt to file Form 990-EZ, you can have the applicable schedules included automatically based on the data you enter at no additional cost.

Form 990-EZ Amended Return

If you need to make any information on a previously filed 990-EZ return, you can easily file an amendment with ExpressTaxExempt.

Note: ExpressTaxExempt allows you to e-file 990-EZ amendment, even if your original return was filed elsewhere.

See why our clients choose ExpressTaxExempt to

File Form 990-EZ Online!

Frequently Asked Questions About Filing Form 990-EZ

What is IRS Form 990-EZ?

Form 990-EZ is an annual information return filed by tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations) whose gross receipts are less than $200,000 and total assets are less than $500,000.

What information is required to file Form 990-EZ?

Form 990-EZ comprises 6 parts. Primarily, you’ll need the following information to complete your 990-EZ e-filing.

- Financial Data: Revenue, expenses, assets, and liabilities

- Programs and Activities: Program service accomplishments, political and lobbying activities, etc.

- Compensation Details: The compensation paid to the key employees of the organization such as director, trustees, etc.

- Other Information: Details regarding the other compliance requirements and organizational changes.

When is the deadline to file my Form 990-EZ?

Form 990-EZ must be filed by the 15th day of the 5th month following the close of the organization’s tax year. If the due date falls on a Saturday, Sunday, or legal holiday, the organizations must file form 990-EZ by the next business day.

If your organization follows the calendar tax year, then the 990-EZ deadline for the 2024 tax year is May 15, 2025. E-File Now.

What are the penalties for failure to file 990-EZ on time?

If your organization fails to file Form 990-EZ within the deadline, the IRS may impose a penalty of $20 - $120 based on your organization's gross receipts. Furthermore, your organization will lose its tax-exempt status upon failing to file 990-EZ for 3 consecutive years.

Is there an extension available for Form 990-EZ?

- Yes! If you need additional time to file your 990-EZ return, you can file Form 8868 and get an automatic extension of up to 6 months.

- If your organization follows the calendar tax year and filed an 8868 extension, then the 990-EZ deadline for the 2023 tax year is November 17, 2025. E-File Now.

How do I amend a previously filed 990-EZ return, and what information can I amend?

You can change any information in your original 990-EZ form except for the organization's EIN. However, you can only make changes to your form after the IRS accepts it.

- If you filed your initial form 990-EZ with our software, simply click the ‘Amend this Return’ option next to the corresponding form, make necessary changes, and e-file it to the IRS.

- If you previously filed the 990-EZ form through a different provider, you can still change it using our software.

Should Form 990-EZ be filed electronically?

Yes! Under the Taxpayer First Act (enacted in July 2019), the IRS mandates that tax-exempt organizations file Form 990-EZ electronically for tax years ending on or after July 31, 2021.

Get started with Tax990 to file your Form 990-EZ online.

Here are the steps to file Form 990-EZ electronically with Tax990:

- Add organization details

- Choose Tax Year

- Enter the required form data

- Review your form summary

- Pay and transmit to the IRS

Helpful Resources for Filing Form 990-EZ

Recent Queries for E-Filing Form 990-EZ

- What type of contributions to be reported in Form 990-EZ?

-

What are the program service revenues that must be listed in

Form 990-EZ? - How can I determine contributions from membership dues while filing Form 990-EZ?

- Our organization filed 990-EZ on time. But the IRS imposed a penalty on us, what would be the reason?

-

What type of miscellaneous expenses must be included in

Form 990-EZ?